ANALYSIS

Crude Oil: Volatile WTI Historical Price vs Stable IEA Projections

International Energy Agency (IEA) 2021-2050 forecasting uses a model with low volatility of crude oil, when in reality it is historically volatile.

In their model, oil price is usually not changing by more than 3% between subsequent years except at the beginning of the period with -3.4% between 2021 and 2022, -10% between 2022 and 2023 and +8.8% between 2023 and 2024. The IEA forecasted a slowing economy in 2022, slowing even further in 2023 and back to normal in 2024. The IEA was forecasting an oil price of $67 in 2022 compared to a realized price of $94/barrel and a projected price of $59 for 2023 compared to actual price of $76/barrel in Q2 2023.

Oil price can be volatile in the short term, but the long-term trend is higher prices. Oil prices saw:

- 23% increase in the last 5 years

- 20% decrease in the last 10 years

- 20% decrease in the last 15 years

- 113% increase in the last 20 years

- 384% increase in the last 25 years

In the last 25 years, oil price has increased on average by 15.4% annually. The last 15 years coincide with a strong oil production growth due to shale oil, but shale oil production has already achieved pick production meaning higher prices in the coming years. Furthermore, from the 15.4% increase, more than 10% are due to a net increase of oil price and not inflation.

The IEA low oil production scenario with a price increase of 4.9% per year (which includes 3% inflation) can still be seen as a conservative scenario as over the last 25 years the average increase has been of 15.4% per year.

Our conclusion, we will see in the next 25 years much higher oil prices than what is expected by the IEA.

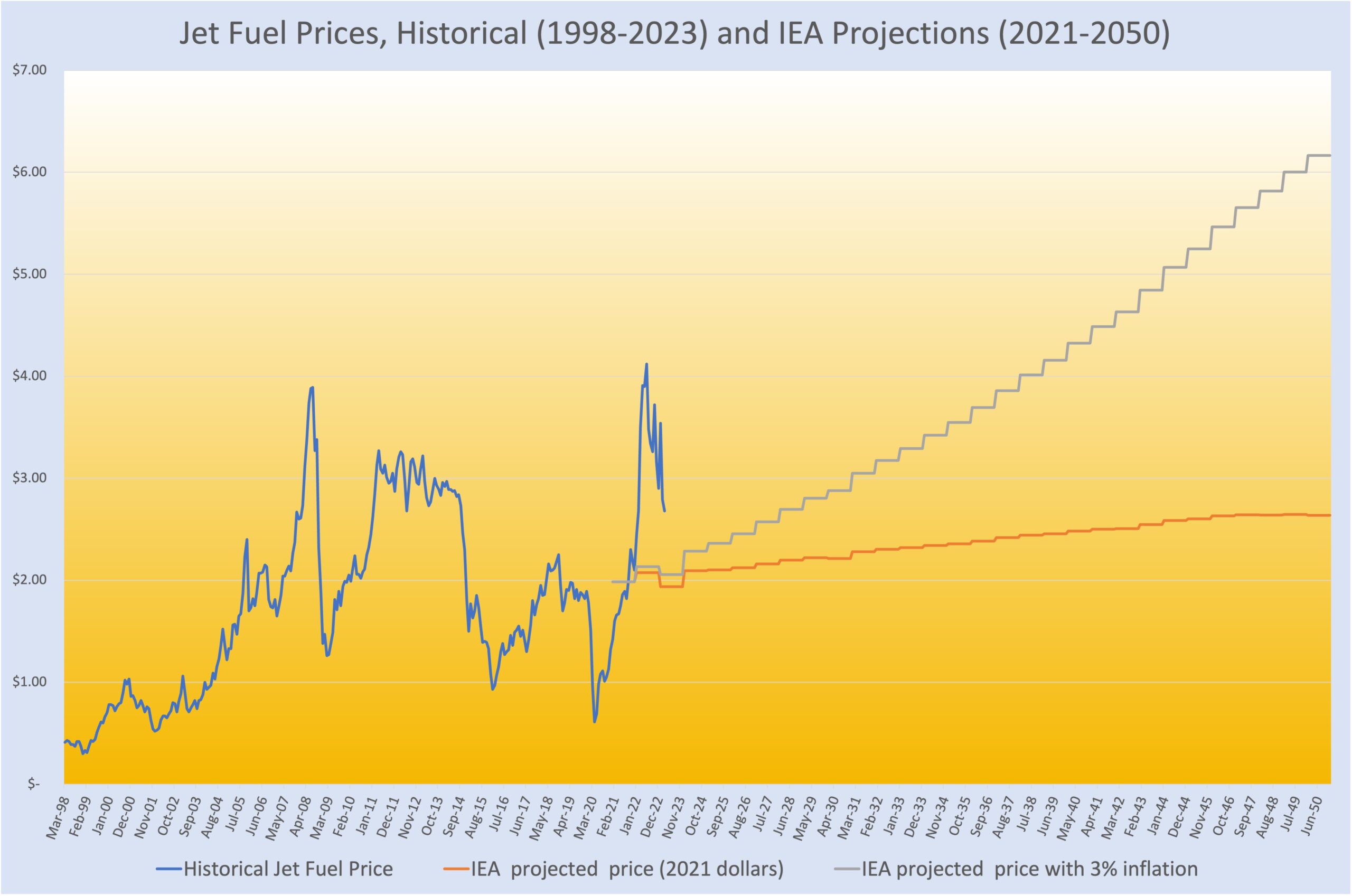

Jet Fuel: Volatile Historical Price vs Stable IEA Projections

Based on its oil forecasting, the International Energy Agency (IEA) has also forecasted jet fuel prices. For the reference scenario, price is starting in 2021 at $1.99/gallon, and jet fuel is increasing to $2.64/gallon in 2050 (in 2021 dollars), a 33% increase or 1.1% per year.

Along with the strong correlation between oil price and jet fuel price, jet fuel price is also historically more volatile than seen in the IEA model, with much higher prices expected as a long-term trend. Historically, jet fuel saw:

- 57% increase in the last 5 years

- 10% decrease in the last 10 years

- 6% increase in the last 15 years

- 174% increase in the last 20 years

- 545% increase in the last 25 years

Over the last 25 years, jet fuel price has increased on average by 21.8% compared to 15.4% for crude oil. Considering refining capacity will not increase in North America, and the fact that jet fuel has been inexpensive over a recent period of 8 years, (from December 2014 to January 2022 jet fuel prices were under their 15-year average US$2.19/gallon), there is a strong rational for a long-term increase of jet fuel prices.

In its low oil supply scenario, the IEA projected a price of $2.07/gallon in 2022 compared to an actual price of $3.37/gallon. If the IEA model is based on this price for 2022, then the readjusted forecast 2050 price would top $4.82/gallon, a total increase of 143% or 4.9% per year. As we are expecting jet fuel price to correct first before restarting its growth, let’s consider a downward correction of around 20% with a price of $2.75/gallon for 2023. In the low oil supply scenario, jet fuel will achieve a price of $4.26/gallon in 2050, a 115% total growth or 4% per year on average.

Jet fuel price has the potential to grow by 4% per year in the next 25 years, a very conservative number given we do not even include inflation.

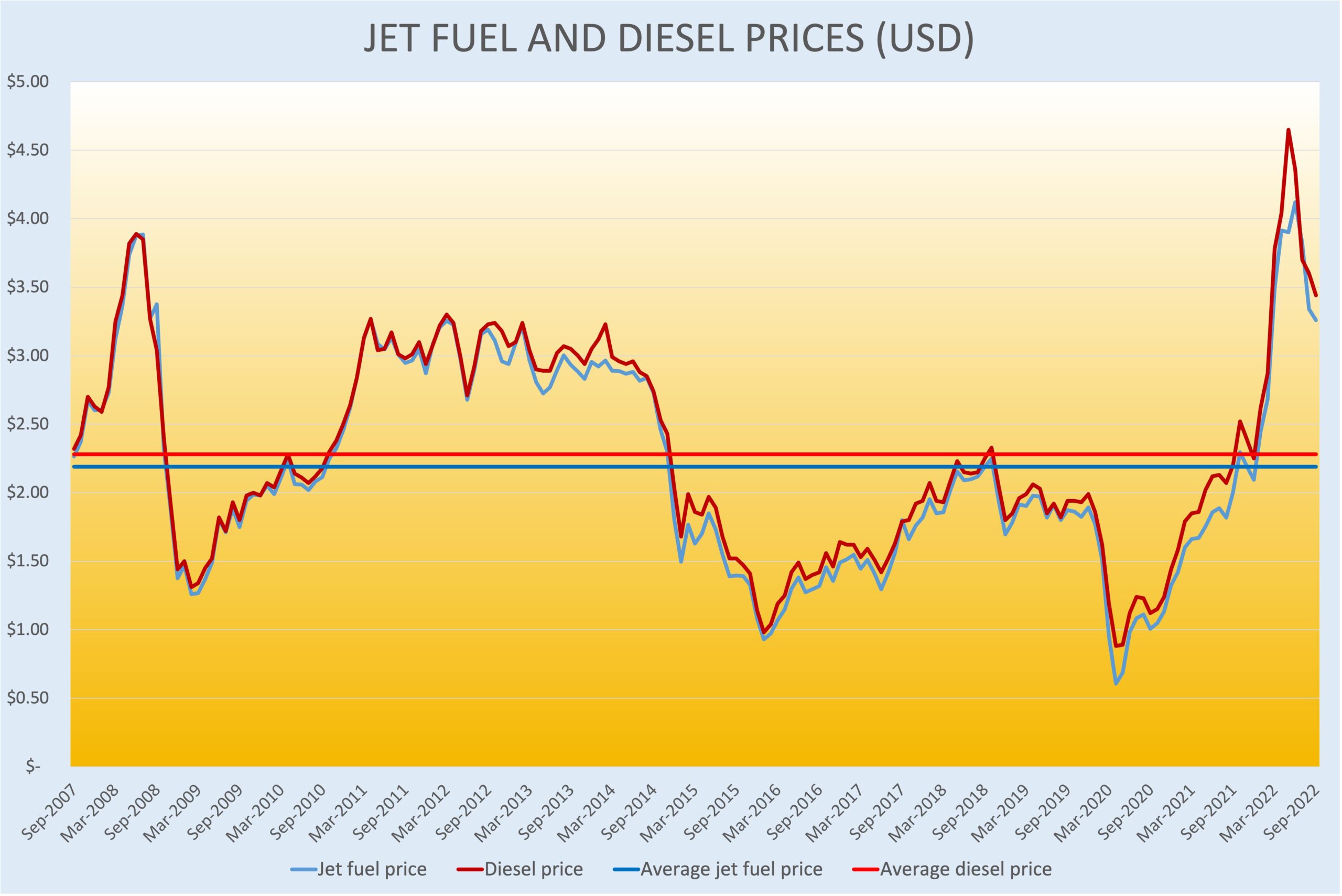

Historical jet fuel and diesel prices

Diesel and jet fuel achieved their highest prices of the last 15 years in May 2022 for diesel (US$4.65/gallon), and June 2022 for jet fuel (US$4.21/gallon). Diesel price was more impacted by the COVID situation than jet fuel, increasing by 20% compared to the high of June 2008, while jet fuel increased by 6% compared to the high of July 2008.

Historically, diesel price is higher than jet fuel price, the only exceptions being 3 consecutive months in 2008, and an additional 3 isolated months since 2007.

Diesel and jet fuel have been cheap over a period of 8 years: from December 2014 to January 2022, diesel and jet fuel prices were under their 15-year average of US$2.28/gallon for diesel, and US$2.19/gallon for jet fuel.

Our expectation, much higher than average diesel and jet fuel prices in the coming years.

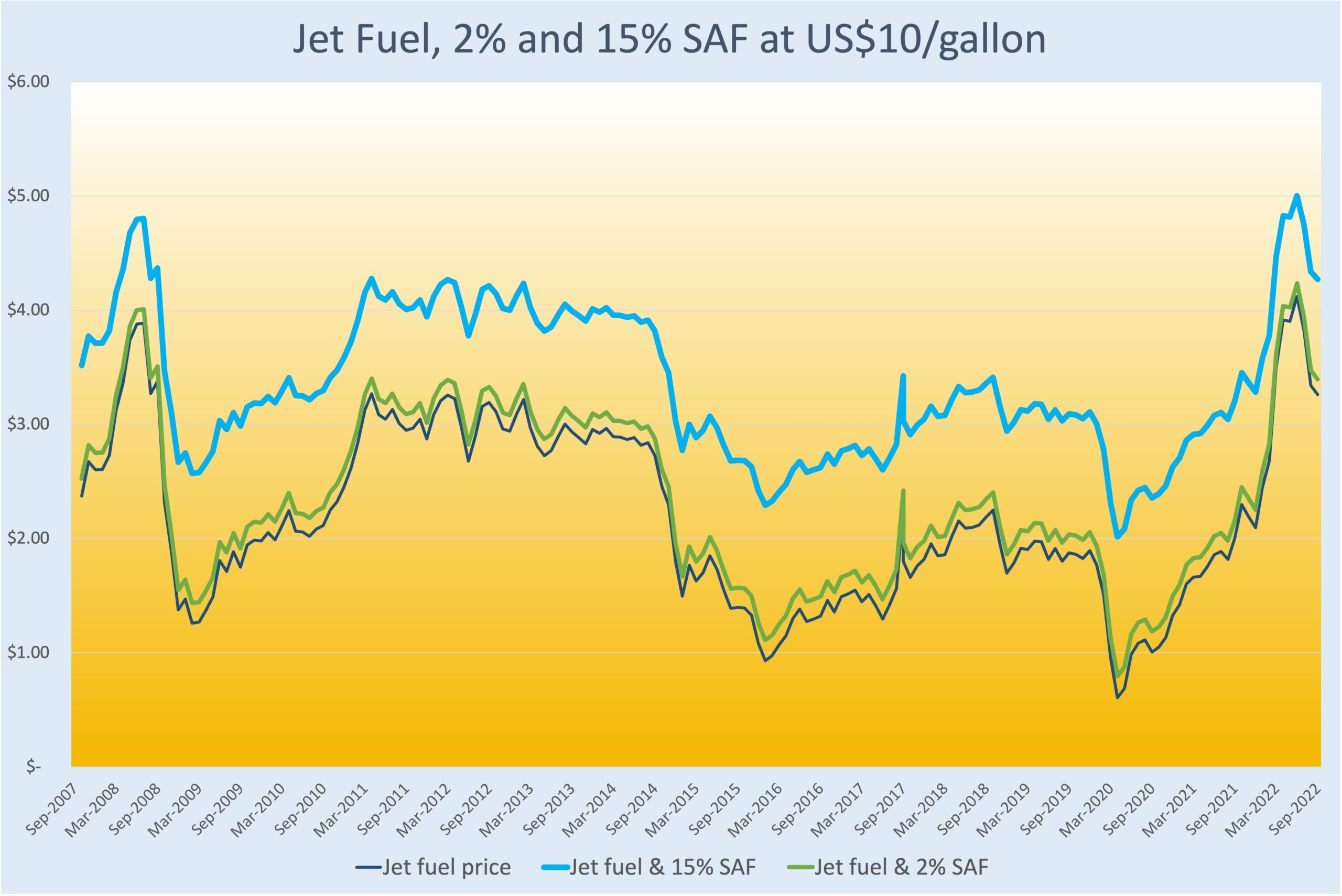

Relationship between jet fuel, SAF and blending

“We can’t use SAF because it is too expensive!” Is this true? Blending cost is the relevant cost to watch; this cost will depend on SAF and jet fuel prices as well as the blending level (percentage of SAF in the total fuel mixture).

Using 2% by 2030 will be a realistic option and a success, 15% will not happen at least until 2050. The cost of jet fuel and SAF will converge over time, with jet fuel price increasing and SAF price decreasing.

The Lufthansa Compensaid compensation program is offering to buy SAF at $10/gallon or close to 5 times more than the average price of jet fuel.

Based on historical jet fuel prices and SAF at US$10/gallon:

- Using 2% is increasing blending cost by 8.5% on average

- Using 15% is increasing blending cost 64% on average

As we are expecting a higher-than-average jet fuel price, we can easily consider a jet fuel 20% higher than the 15-year average or US$2.63/gallon (still 20% lower than September 2022 price). Based on this price, blending cost will increase by:

- 9 cents or 5.6% with the use of 2% SAF

- US$1.1 or 42% with the use of 15% SAF

Will climate change policies shrink the airline industry?

As all other sectors of the economy, the airline industry has jumped into the climate change race to net zero emissions by 2050. The general expectation is an emission reduction of 80-85% compared to 2006, an ambitious target. The 3 main tools to achieve this target will be: 1) market measures (offsets), 2) energy efficiency, which is traditionally not large enough to compensate for emissions growth, and 3) fuel switching, such as drop-in fuels like sustainable aviation fuels (SAF), but also new sources of energy like some hydrogen in the very long term and more electrification, (even if they may take more time than expected based on the experience with the Boeing B787).

Interestingly, existing forecasts of future fuel consumption and emissions are based on historical data with the expectation of having the future mimicking the past. Therefore, the economic context of the next 20 years is generally expected to be a copy of the last 20 years and switching to more expensive and less efficient fuels will have no negative impacts on the aviation sector (without even taking into consideration the large investments required to switch to new sources of non-drop-in fuels).

At Theia, we don’t agree with this vision of the world. Accordingly, in this proposed analysis we will only focus on the utilisation of SAF, its financial impact on airlines, the demand destruction for travel, and related fuel consumption reduction.

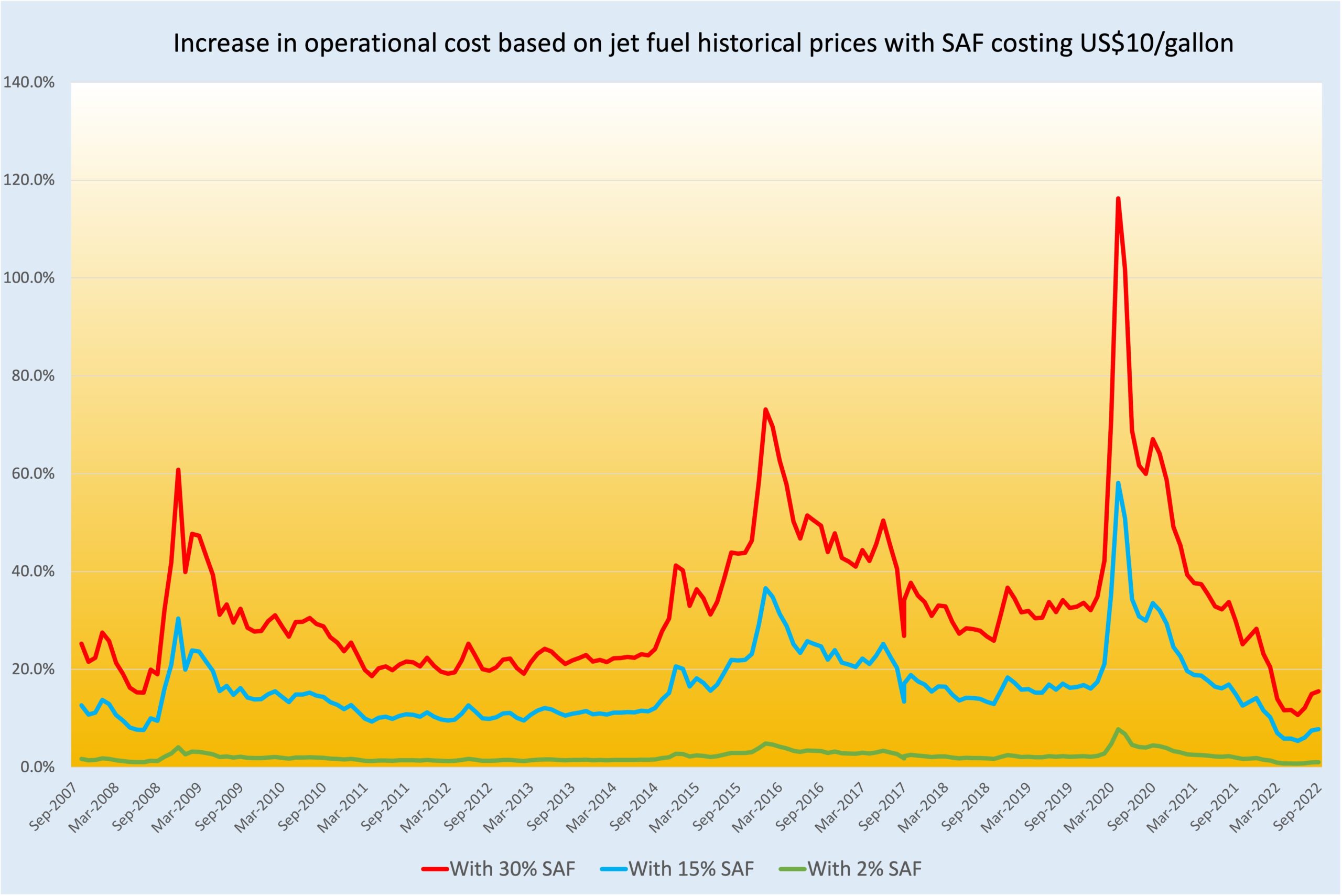

With fuel representing 25% to 30% of airline operating costs, fuel expense is significant, and it will be higher with SAF and will increase further with higher blending levels. For the period of September 2007 to September 2022, and using a SAF price of US$10/gallon, operating costs will increase by:

- 0.7% to 8% when only 2% SAF is used

- 5% to 58% when 15% SAF is used

- 11% to 116% when 30% SAF is used

Using 2% SAF is clearly not an issue. Using 15% can be problematic if jet fuel price is low, but as we are expecting jet fuel price to stay high it could be a financially acceptable option. Using 30% is clearly not going to work.

Airlines will be able to implement the use of 2% SAF by 2030 even without transferring the cost to their clients; although, we are expecting them to transfer at least 50% of the cost to their clients. Airlines will still be able to implement a 15% SAF use by 2035 as jet fuel price will be more expensive than the historical average, but the extra cost will probably be fully transferred to the clients. It is also important to remember that the total fuel cost in absolute value will also increase due to an increase in jet fuel prices.

Using more than 30% will be a financially untenable situation for the airlines and will require the full transfer of the extra cost to clients.

If the industry was able to reduce SAF cost by 30% by 2035 (including 12 years of inflation) or to US$7/gallon, operational costs will now increase by:

- 3% to 40% when 15% SAF is used

- 5% to 79% when 30% SAF is used

Using more than 15% is still going to heavily impact the operating costs of airlines.

In this context, why not just transfer the total cost to the clients? The response is simple, clients have limited purchasing power and buying an airline ticket will be part of a trade-off between different purchases. In other words, airlines must deal with the elasticity demand for travel where travel decreases when the price of airline tickets increases due to airlines transferring the cost of SAF to clients.

To determine the additional price per passenger, we need to determine the GHG emissions per passenger. A new trend is for airlines to provide the GHG emissions when booking a trip, but this trend is only the “beginning of the journey” for the airlines. Airlines are reporting different GHG emissions per passenger for flying in economic, premium economic, and business class. Some airlines are reporting 50% more emissions for premium economy and 4 times more for business class. It is difficult to understand the rational as most of the aircraft weight is not coming from the seats but from the aircraft and the fuel. Interestingly, based on the data provided by the airlines of total emissions and seat capacity, the GHG emissions per passenger are actually 50% lower than the GHG emissions suggested by the airlines for a trip in economy class. Results will also depend on the specific type of aircraft used for the calculation. For example, we are using a Boeing B777-300ER for the Toronto to Vancouver flight but using an Airbus A321-200 will provide a result close to the one for the Toronto to Calgary flight.

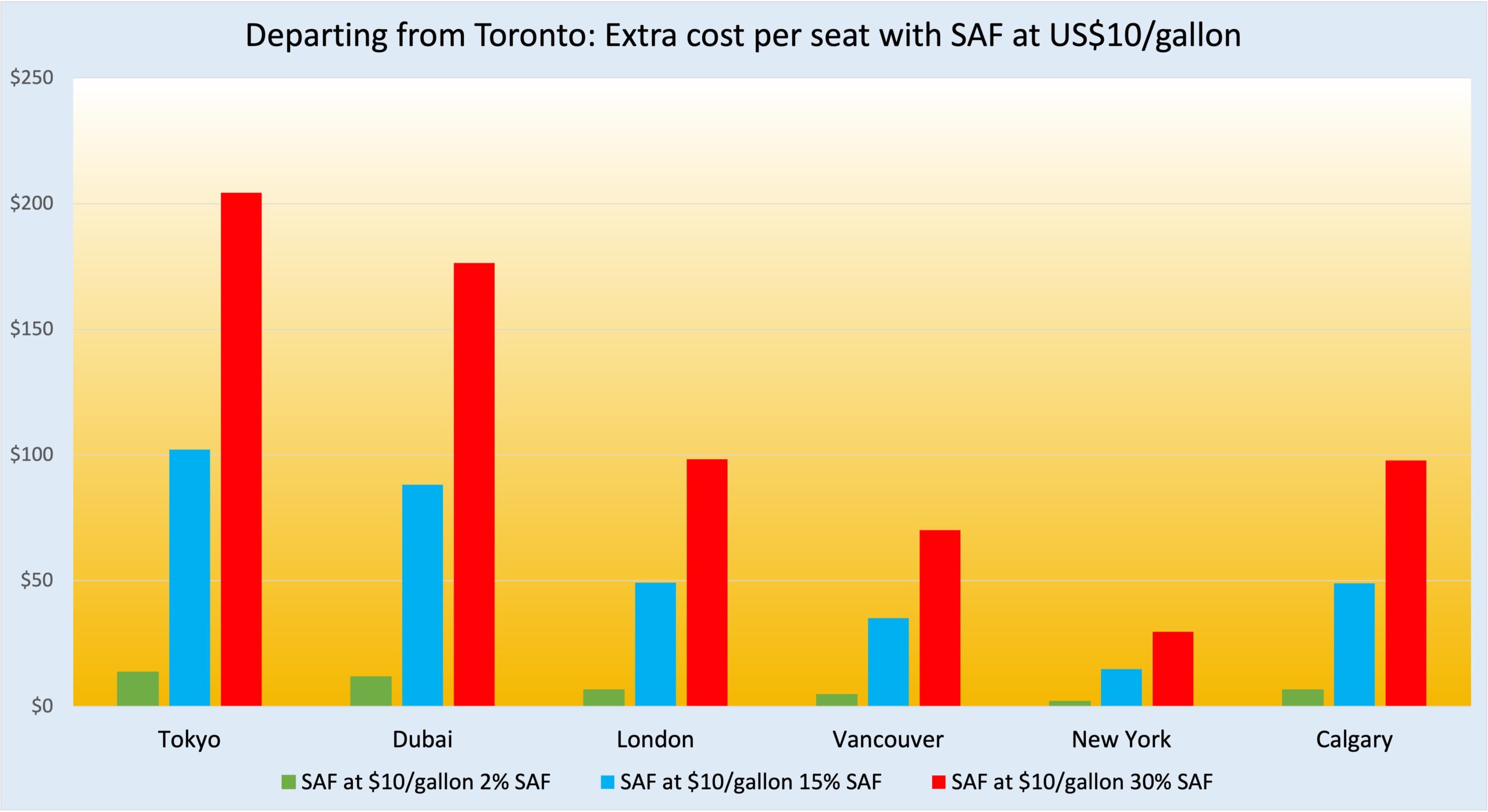

Based on current airline data provided for economy class, using 2% to 30% SAF priced US$10/gallon and using the jet fuel price of September 2022 (US$3.26/gallon), prices will increase by:

- US$14 to US$204 when flying from Toronto Pearson to Tokyo Narita

- US$7 to US$98 when flying from Toronto Pearson to London Heathrow

- US$5 to US$70 when flying from Toronto Pearson to Vancouver International

- US$2 to US$30 when flying from Toronto Pearson to New York Newark

Using 2% SAF will increase ticket prices by up to 2%, a very limited impact.

Using 30% SAF will increase ticket prices by 25% to 35% depending on the destination and could have a significant impact, even if it is not clear how to benchmark airline ticket prices.

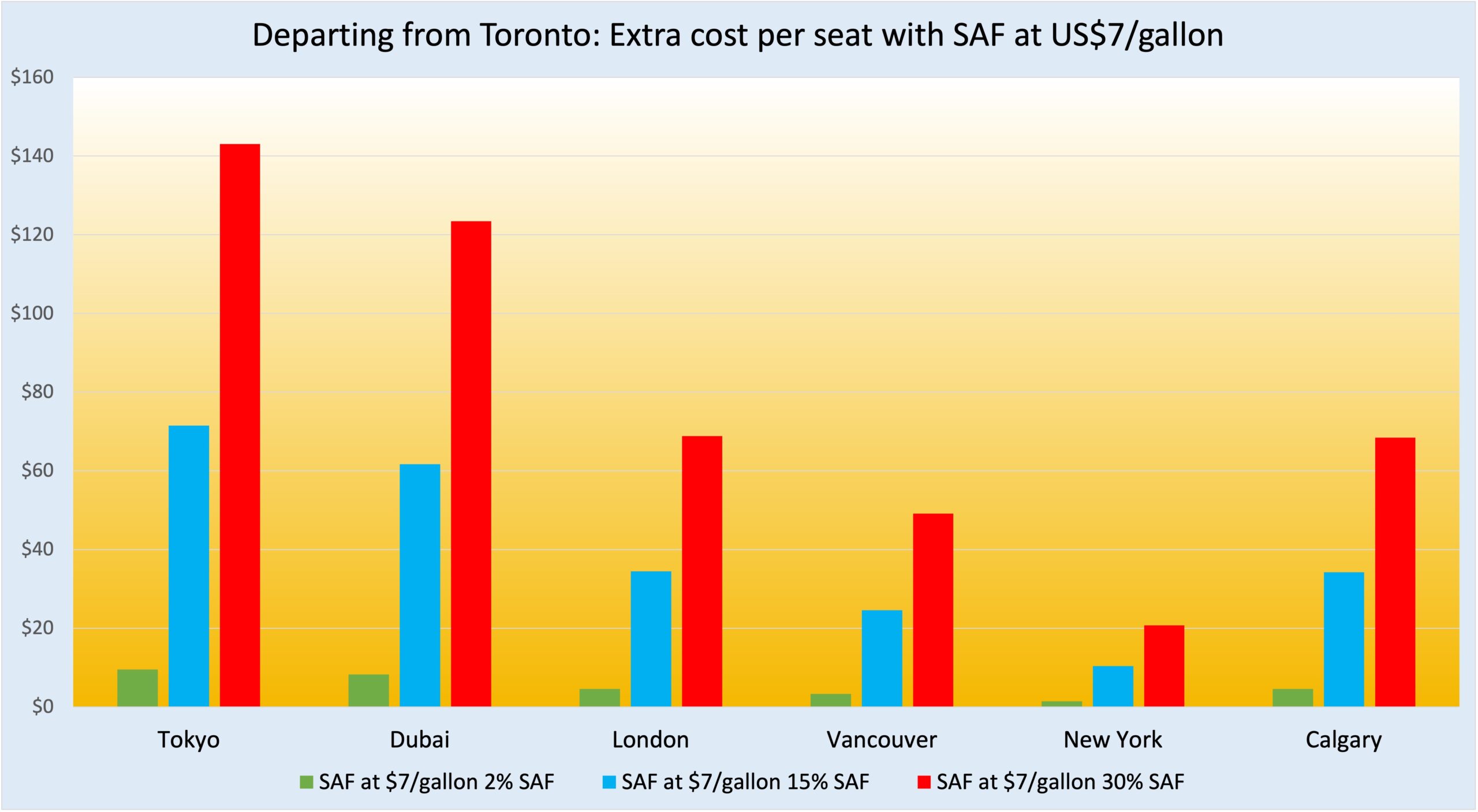

If the cost of SAF was reduced to US$7/gallon, prices will increase by:

- US$10 to US$143 when flying from Toronto Pearson to Tokyo Narita

- US$5 to $69 when flying from Toronto Pearson to London Heathrow

- US$3 to $49 when flying from Toronto Pearson to Vancouver International

- US$1 to $21 when flying from Toronto Pearson to New York Newark

In this context, using 30% SAF will increase ticket prices by 17% to 25% depending on the destination and could again have a significant impact.

In this context, what would be the impact on travel demand?

An IATA study reports the following elasticity for travel demand in response to price change: at flight level, elasticity of -1.5 for short haul and -1.4 for long haul flights; at the supra-national level elasticity is reduced to -0.7 for short haul and -0.6 for long haul.

When SAF costs US$10/gallon, travel demand is expected to decrease by 15% to 52.5% depending on the elasticity. If price of SAF is reduced to US$7/gallon, travel demand is expected to decrease by 10.2% to 37.5% depending on the elasticity.

Using 30% SAF after 2035 could have a devastating impact on travel demand, the impact is very large even in the best-case scenario.

In conclusion, without a drastic and accelerated reduction in SAF prices, future emissions will be reduced due to a marked decrease in travel demand resulting from SAF use. Net zero may be achieved by less total GHG emissions resulting from lower travel and not from fuels with less GHG emissions.

The pathway to 2035 is critical, without reducing SAF price well below US$7/gallon, SAF use will top at 30% and travel will decrease. We are getting closer and closer to “V1”, and actions to accelerate the development and the reduction of SAF are needed right now.